2024 Schedule C Form 1040

2024 Schedule C Form 1040 – Schedule A (Form 1040 or 1040-SR): Itemized Deductions is it is $20,800. For the tax year 2024, the standard deduction for single taxpayers and married couples filing separately is $14,600. . Only those students who have cleared the JEE Main 2024 exam and are ranked among the top 2.5 lakh candidates can appear for the upcoming JEE Advanced exam. Additionally, students in the general .

2024 Schedule C Form 1040

Source : www.nerdwallet.com

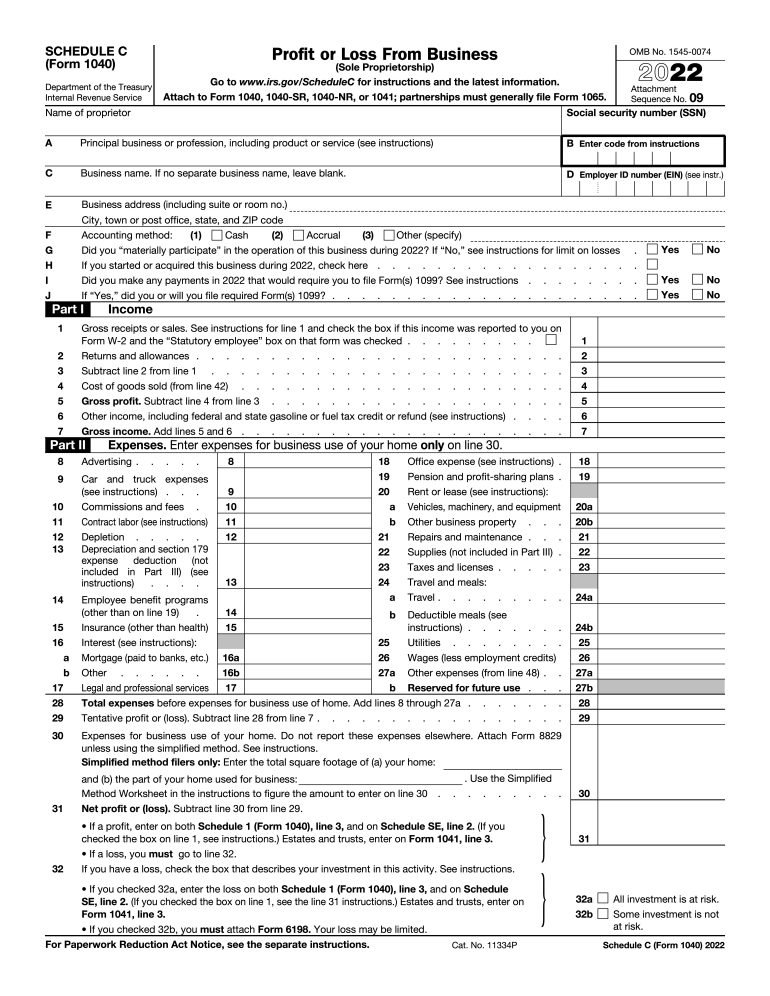

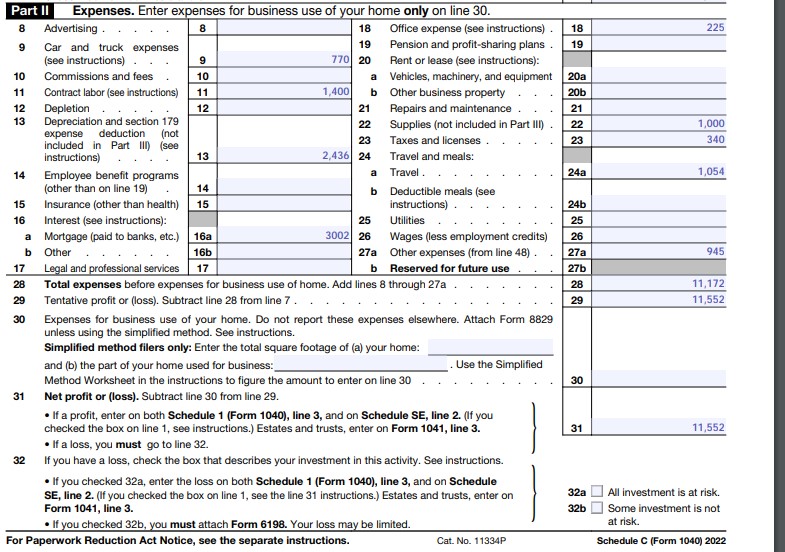

How To Fill Out Your 2022 Schedule C (With Example)

Source : fitsmallbusiness.com

Business tax deadlines 2024: Corporations and LLCs | Carta

Source : carta.com

Property Tax Listing – Town of Milton, Buffalo County, Wisconsin

Source : townofmiltonwi.gov

What Is a Schedule C IRS form? TurboTax Tax Tips & Videos

Source : turbotax.intuit.com

Form 1040 for IRS 2023 2024 ~ What is it? Schedule A B C D

Source : www.incometaxgujarat.org

Schedule C 1040 line 31 Self employed tax MAGI instructions home

Source : individuals.healthreformquotes.com

Cracking the Personal Tax Return Code Part 1: Form 1040, Schedules

Source : financialedinc.com

What Is Schedule C (IRS Form 1040) & Who Has to File? NerdWallet

Source : www.nerdwallet.com

Schedule C Filers Now Eligible for Larger PPP Loans Wegner CPAs

Source : www.wegnercpas.com

2024 Schedule C Form 1040 What Is Schedule C (IRS Form 1040) & Who Has to File? NerdWallet: The Assam State Level Eligibility Test Commission has initiated the registration process for the Assam State Eligibility Test (SET) 2024. As per the official notification, candidates have until . While filling out the application form of NIFT 2024, candidates will also have to upload required documents and make the payment of NIFT 2024 registration fee. Aspirants are advised to keep NIFT .