2024 Schedule C Deductions

2024 Schedule C Deductions – Additionally, the IRS adjusted its standard deduction for 2024. That allows for households to deduct more of their expenses from qualified deductions (such as mortgage insurance, charitable . The IRS has released the 2024 standard deduction amounts that you’ll use for your 2025 tax return. Knowing the standard deduction amount for your filing status can help you determine whether you .

2024 Schedule C Deductions

Source : www.facebook.com

Bender’s Dictionary of 1040 Deductions | LexisNexis Store

Source : store.lexisnexis.com

Green Books Cannabis Accounting

Source : m.facebook.com

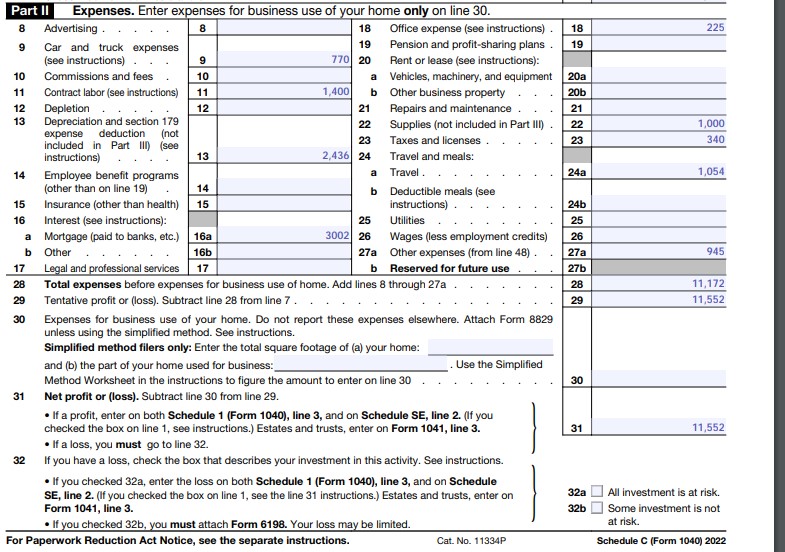

How To Fill Out Your 2022 Schedule C (With Example)

Source : fitsmallbusiness.com

Compliance LLC | Beckley WV

Source : m.facebook.com

Year End Considerations for Small Business

Source : www.thinkholsinger.com

Lotanae C Macon LLC

Source : m.facebook.com

Blog | Senter, CPA, P.C.

Source : sentercpa.com

Conner Ash P.C. Certified Public Accountants and Business

Source : m.facebook.com

Business tax deadlines 2024: Corporations and LLCs | Carta

Source : carta.com

2024 Schedule C Deductions Safe Harbor Bookkeeping DFW: There are other tax changes happening next year that could put more money in your paycheck. If you collect Social Security, you’ll receive a 3.2% cost-of-living-adjustment in 2024. And since the first . The Maharashtra Public Service Commission (MPSC) has released the anticipated examination schedule for March 17 and July 27, 2024. The Non-Gazetted Group B and Group C Services Joint .